Want Secure KYC-Compliant Network?

Enable identity-verified transactions across your platform with full regulatory alignment

Our platform supports a fully KYC-compliant network that ensures every user is verified before initiating any financial activity. Whether you’re running a fintech app, wallet service, or financial marketplace, we help you stay ahead of compliance requirements—without adding friction to the user experience.

Build Trust with Every User – Power Your Platform with KYC-Verified Access

Ensure regulatory compliance, prevent fraud, and streamline user onboarding with a robust, secure, and fully KYC-compliant verification network.

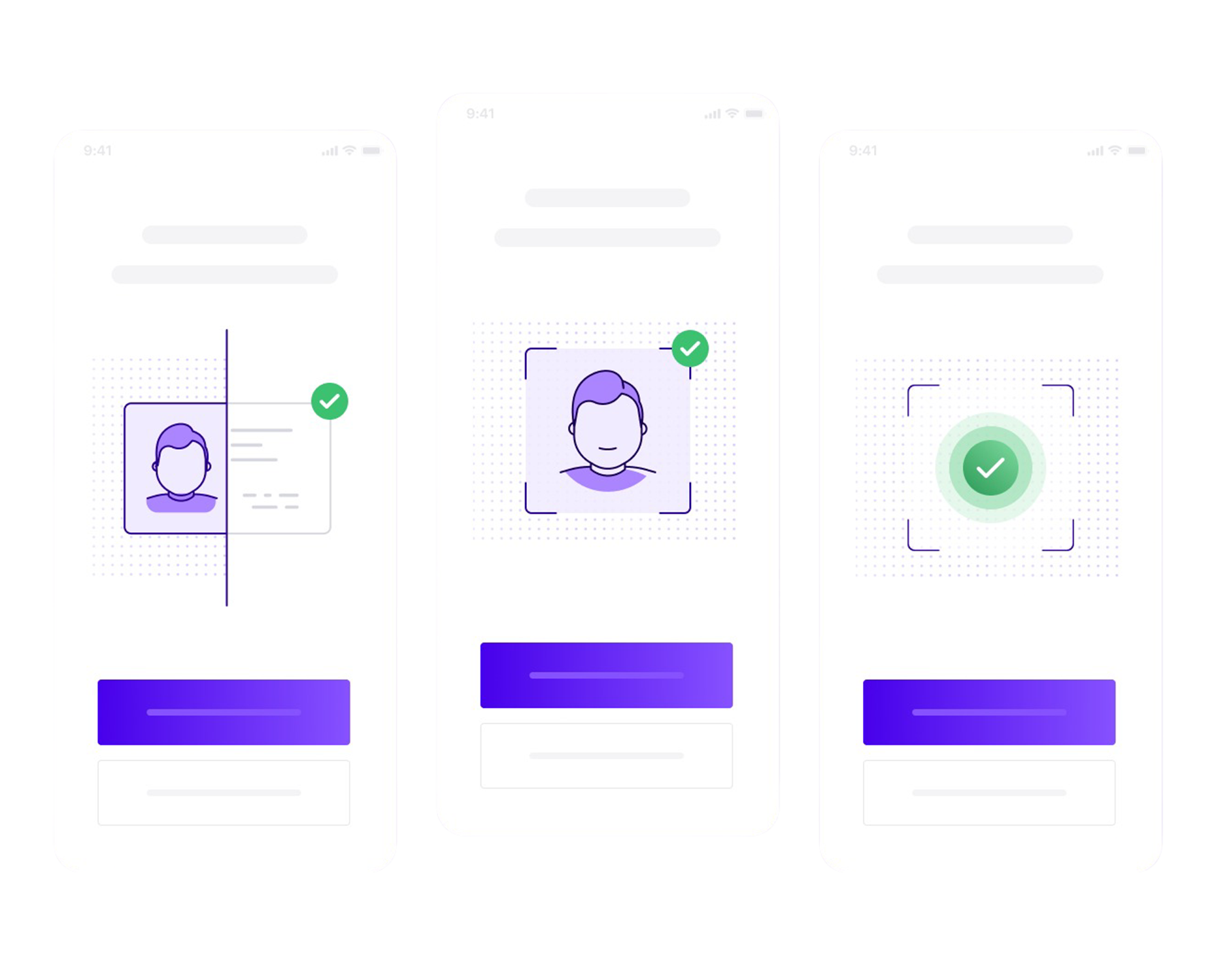

End-to-End User Verification

Enable secure onboarding with full PAN, Aadhaar, and document-based KYC checks—automated and compliant with regulatory norms.

Real-Time Validation

Authenticate user details instantly with API-driven checks, reducing onboarding time and improving accuracy across platforms.

Regulatory Compliance Built-In

Stay aligned with RBI and industry regulations effortlessly—our infrastructure ensures your system is always audit-ready.

Seamless Integration

Add KYC workflows into your app or website with flexible APIs and SDKs, supporting fast deployment and minimal dev effort.

Secure Data Handling

All sensitive user data is encrypted, stored securely, and handled per compliance standards like PCI DSS and ISO 27001.

Fraud Prevention at the Core

Identify suspicious users early with AI-backed risk scoring, blacklist checks, and device fingerprinting—keeping your network clean and safe.

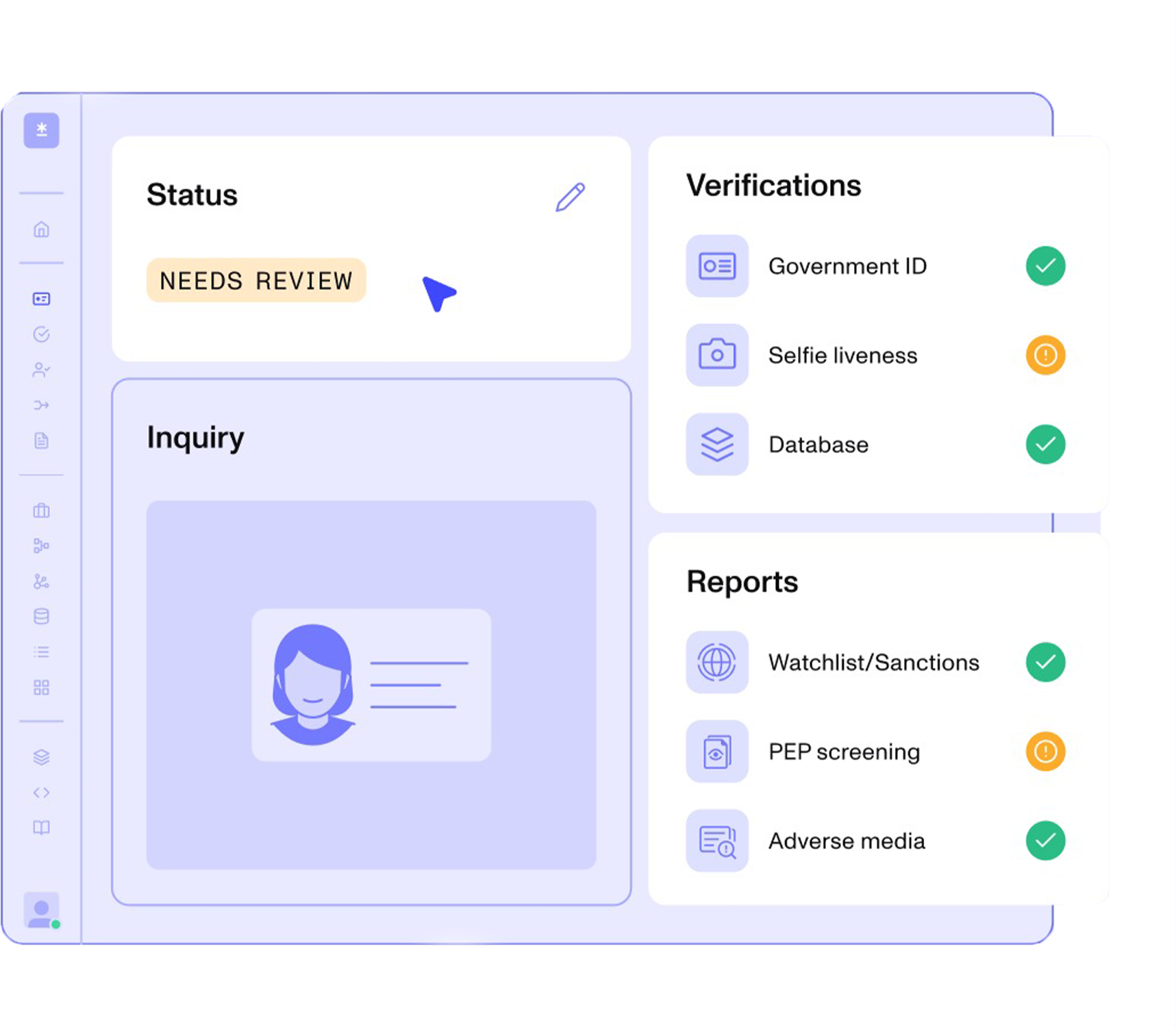

Built for Compliance and Confidence

Whether you’re building a financial platform, onboarding users, or verifying identities, our KYC-compliant network is designed for scale, speed, and security. Every user is verified through regulatory-grade checks—automated for speed, yet thorough for compliance. Reduce fraud, meet local and global regulations, and create a trusted environment for seamless user interactions. From initial verification to periodic updates, our infrastructure supports full compliance without slowing down your growth.

FAQ

Frequently Asked Question

Find clear answers to all your questions about accepting local and international payments, supported methods, currency settlements, security, integration, and more.

A KYC-compliant network ensures that every user undergoes Know Your Customer (KYC) verification before accessing financial or identity-sensitive services. This includes document verification, biometric checks, or e-KYC processes.

KYC helps prevent fraud, money laundering, and identity theft by verifying the identity of users. It’s also a regulatory requirement in most jurisdictions for financial platforms.

We support multiple KYC options including full KYC (manual document upload), e-KYC (via government APIs), and video KYC, depending on your region and compliance needs.