Build Trust with Every Transaction

Escrow-Powered Payments for Smarter Deals

Say goodbye to payment uncertainties. Our escrow-based transaction system protects both parties by holding funds securely until terms are fulfilled. Whether you’re managing high-value trades or freelance gigs, escrow adds a layer of accountability and peace of mind.

Experience risk-free payments, transparent status tracking, and seamless release mechanisms—engineered for mutual trust and secure deals.

Why Choose Escrow-Based Transactions?

Gain unmatched security and transparency for high-stakes or trust-sensitive payments. Our escrow solution ensures funds are only released when both parties are satisfied—minimizing disputes and maximizing trust.

Secure Fund Holding

Payments are safely held in escrow until all agreed-upon conditions are met, protecting both buyer and seller.

Reduced Risk of Fraud

Transactions are only completed once both parties have fulfilled their commitments—minimizing chances of scams or payment disputes.

Customizable Release Conditions

Define milestones, delivery checks, or time-based triggers for fund release to suit different deal types.

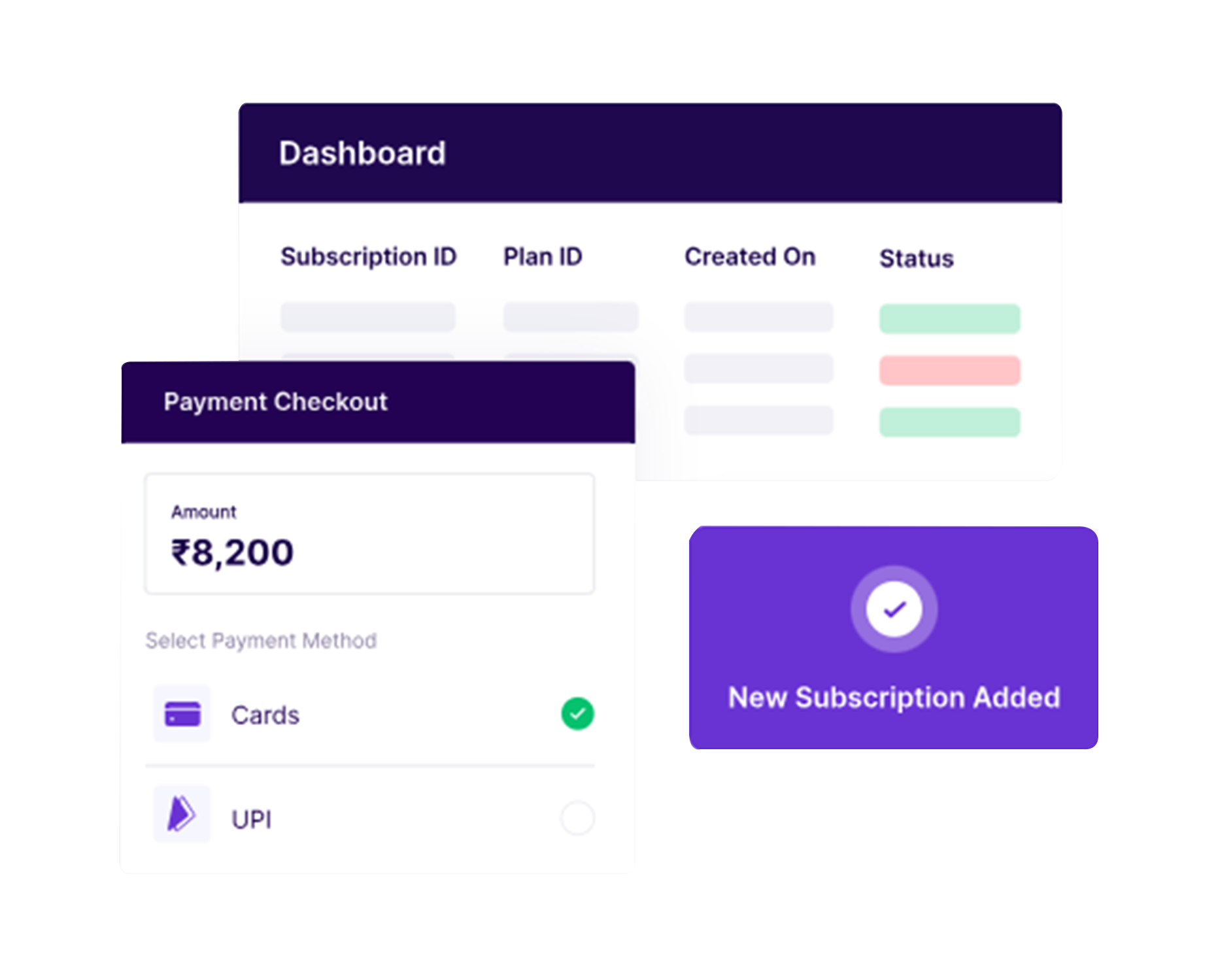

Real-Time Status Tracking

Monitor transaction progress with live updates, giving all parties full visibility and control.

Automated Settlement Process

Once conditions are verified, funds are released instantly—ensuring a smooth and timely experience.

Ideal for High-Value Transactions

Perfect for freelance jobs, marketplace deals, and B2B contracts where trust and assurance are essential.

Key Benefits of Escrow-Based Transactions

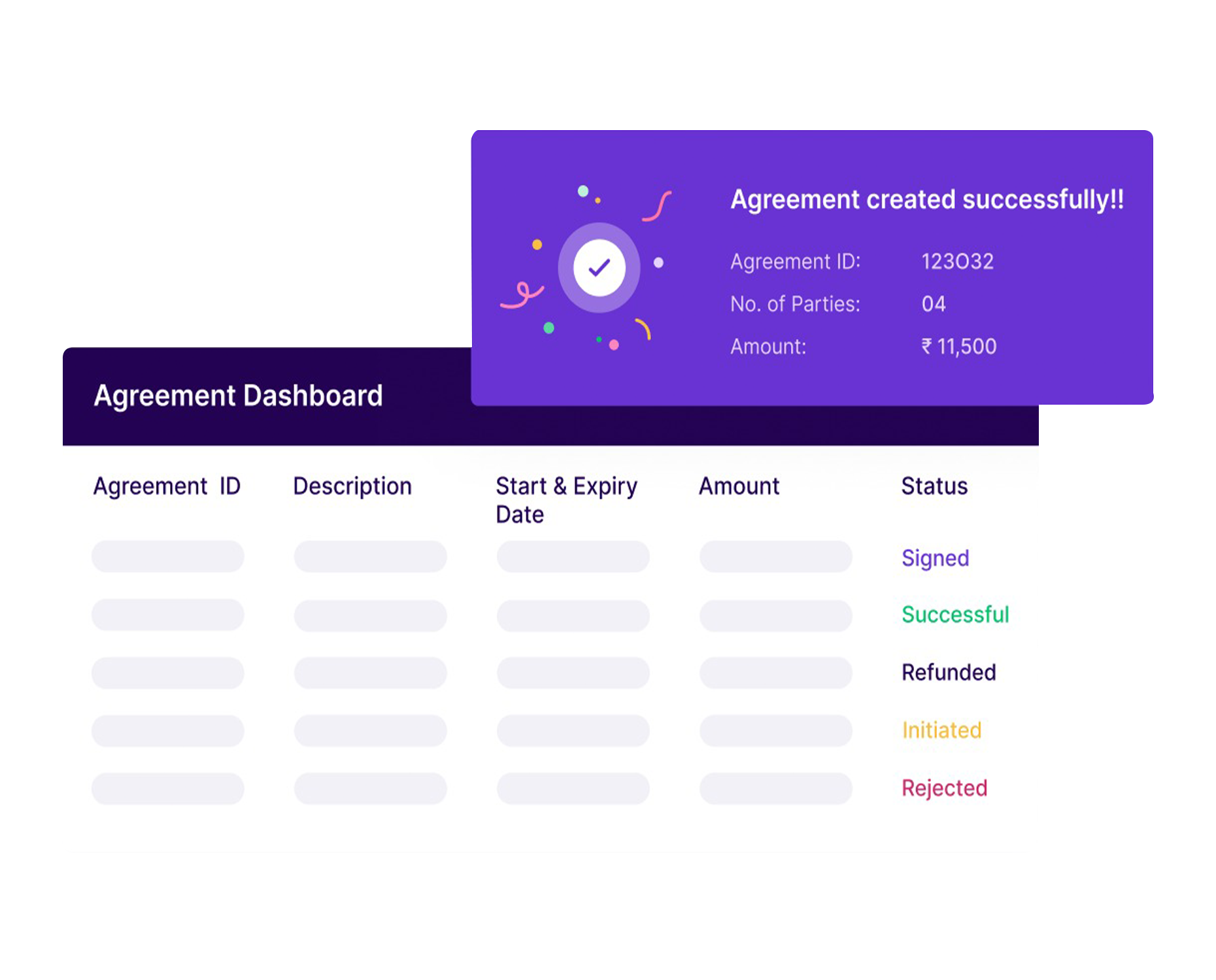

Trust-Focused Payment Flow – Funds are held safely and only released when all agreed terms are met.

Clear Contractual Terms – Define exactly what needs to be delivered before money changes hands.

Supports Milestone Releases – Ideal for staged projects; release funds step-by-step based on progress.

Minimizes Disputes – Reduces chances of fraud, miscommunication, and payment-related conflicts.

Works Globally – Seamless for both domestic and international transactions.

Transparent Tracking – Keep tabs on your escrow activity with a real-time dashboard and status updates.

Transact with Confidence Using Escrow

Take the risk out of online payments. Our escrow-based transaction solution safeguards both parties by holding funds securely until agreed conditions are fulfilled. Whether it’s for services, digital goods, or business deals, every transaction is protected, verified, and released only when trust is earned.

FAQ

Frequently Asked Question

Find clear answers to all your questions about accepting local and international payments, supported methods, currency settlements, security, integration, and more.

An escrow-based transaction involves holding funds in a secure third-party account until the buyer confirms receipt of goods or services, ensuring trust and fairness for both parties.

The buyer sends funds to the escrow account. Once the seller delivers the product or service and the buyer confirms satisfaction, the funds are released to the seller.

Yes, all funds are securely held in compliance with industry standards and released only after confirmation, minimizing risk of fraud or dispute.

If a buyer and seller disagree, our support team or a built-in resolution mechanism will step in to mediate and resolve the issue fairly before releasing any funds.

Anyone—from individuals making online purchases to businesses managing large transactions—can benefit from escrow for added security and transparency.